Press Release

IVL Rights Issue Fully Subscribed Investors back company's future growth plans

Bangkok - 28 February 2011 - In a tremendous show of confidence, shareholders of Indorama Ventures Public Company Limited, the world's leading vertically integrated Polyester Value Chain producer, decided overwhelmingly to subscribe to the company's rights issue, which closed on 25 February, and support the company's four year expansion plan. A total of 99.7% of the company's TSRs, or Transferable Subscription Rights, were converted to 480 million shares by the closing date, raising US$ 566 million (Baht 17,279 billion).

The company's major shareholder, Indorama Resources subscribed fully, as did another key shareholder, Bangkok Bank. The company's Group CEO, Mr. Aloke Lohia expressed his confidence that shareholders were now fully conversant with the high growth they could expect from IVL and were backing the company to pursue its goals.

"We have explained our future plans expansively to investors and we believe that what we have laid out in our Aspiration 2014 to be a highly achievable target," said Mr. Lohia. "We are now fully prepared to move forward and reward our shareholders for their investment."

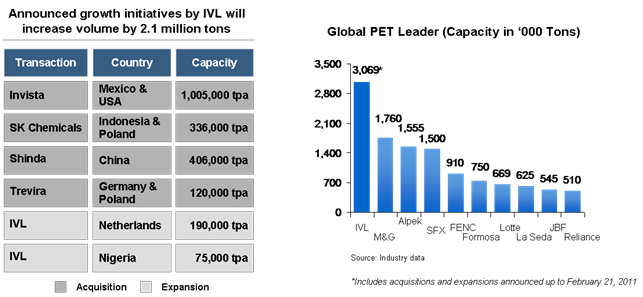

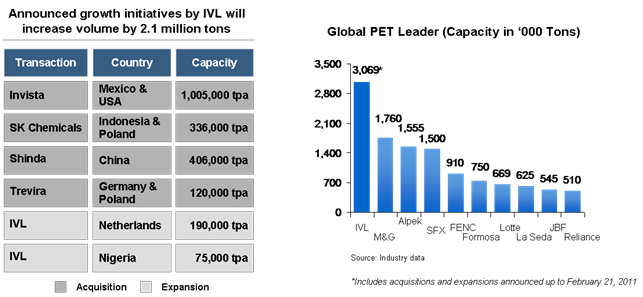

Indorama Ventures first notified shareholders on 17 December 2010 of its ambitious plan to raise its capacity from 3.2 million tons per annum in 2010 to 10 million tons per annum by 2014. The plan calls for an investment of US$3.8 billion with approximately US$0.9billion earmarked for acquisitions announced in 2010. The remaining US$2.9 billion will be financed with the rights issue proceeds, debt and internally generated cash flow.

The company's major shareholder, Indorama Resources subscribed fully, as did another key shareholder, Bangkok Bank. The company's Group CEO, Mr. Aloke Lohia expressed his confidence that shareholders were now fully conversant with the high growth they could expect from IVL and were backing the company to pursue its goals.

"We have explained our future plans expansively to investors and we believe that what we have laid out in our Aspiration 2014 to be a highly achievable target," said Mr. Lohia. "We are now fully prepared to move forward and reward our shareholders for their investment."

Indorama Ventures first notified shareholders on 17 December 2010 of its ambitious plan to raise its capacity from 3.2 million tons per annum in 2010 to 10 million tons per annum by 2014. The plan calls for an investment of US$3.8 billion with approximately US$0.9billion earmarked for acquisitions announced in 2010. The remaining US$2.9 billion will be financed with the rights issue proceeds, debt and internally generated cash flow.